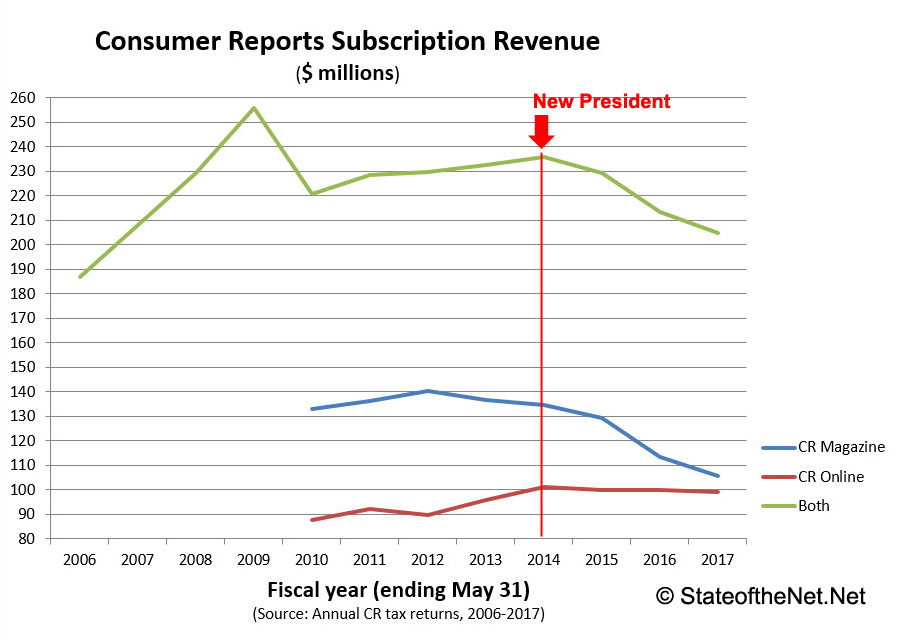

The band of executives who took over Consumer Reports a few years ago and destroyed its editorial staff are now demolishing the organization financially, presiding over not just plummeting revenues but the first major decline ever in subscriptions to Consumer Reports Online, the magazine’s 21-year-old website.

Let’s take a look at the worrisome financials before considering the kind of dysfunctional leadership that is responsible for them. (Disclosure: I was an editor at Consumer Reports from 1990-2014.)

Sales are way down

During the first three years that CR’s President, Marta Tellado, and her team have been in charge (see Arrow), combined revenues of the flagship products, Consumer Reports Magazine and Consumer Reports Online, declined by about $31 million or more than 13 percent.

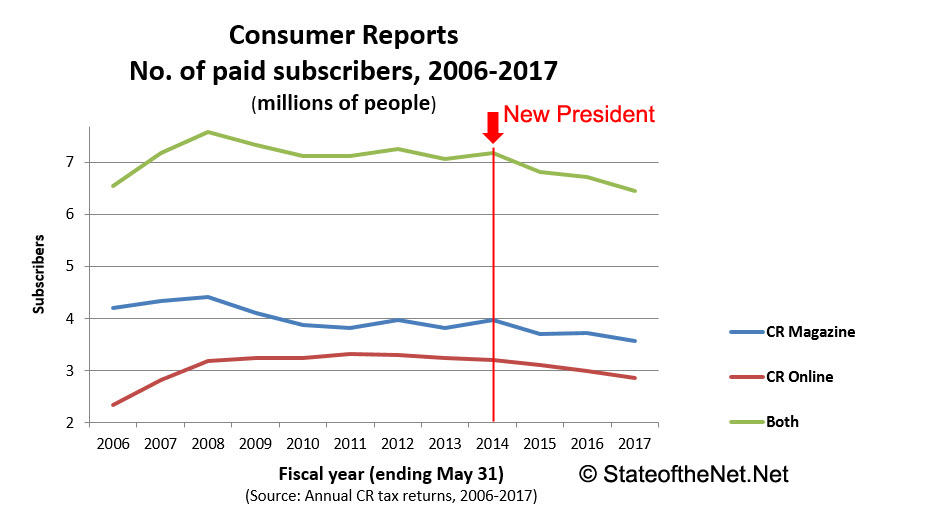

Subscribers are leaving, including online

During the same period, nearly three-quarters of a million fewer people subscribed to the two products. Nearly half of that plunge was in the number of subscribers to Consumer Reports Online. Declines in print subscriptions are widespread in the publishing industry, but online subscriptions are supposed to be increasing to compensate for them, not decreasing.

Losses are mounting

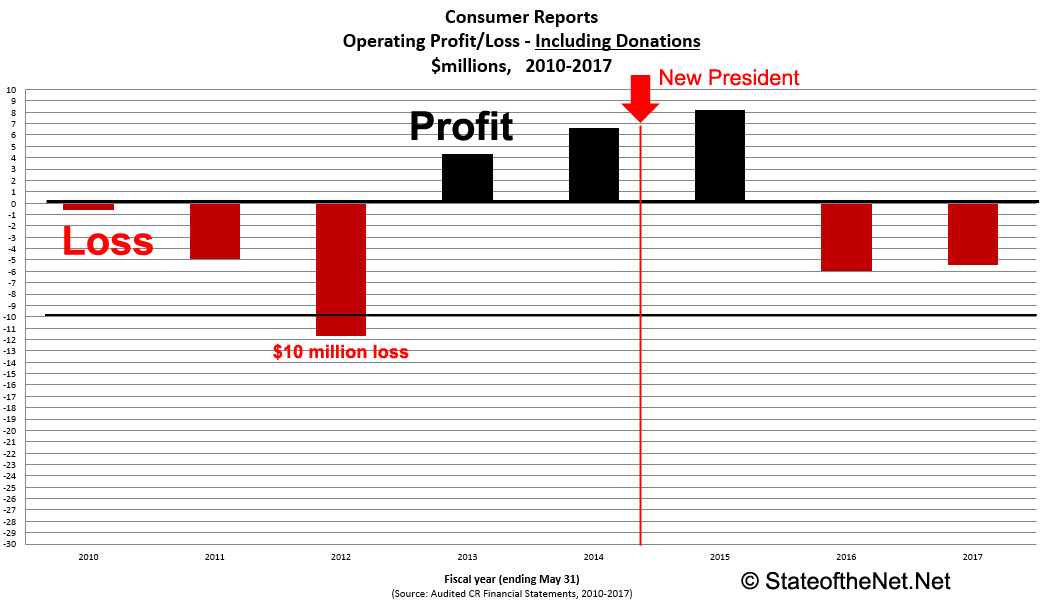

Flagging sales has also taken its toll on CR’s bottom line. After one year in the black under Tellado, CR has suffered two consecutive years of operating losses, each exceeding $5 million. That CR operations lost that much in fiscal 2017 may not be obvious from its audited financial statement, the bottom line of which shows a gain (technically referred to as an “Increase in net assets”) of more than $31 million. But such a net gain can be misleading. A closer look shows that the bottom line has been boosted with such “non-operating” items as $29 million in investment income, which have nothing to do with how profitably CR operates.

Any organization that relies, year after year, on investment income to compensate for operating losses, is headed for trouble. For when investment income inevitably heads south—as it did for CR in 2016 the tune of an $8.9 million loss—it can no longer camouflage a poorly run operation.

As the financial reference site InvestingAnswers explains:

“Operating income, or EBIT, is important because it is an indirect measure of efficiency. The higher the operating income, the more profitable a company’s core business is…operating income is also a measure of managerial flexibility and competency, particularly during rough economic times.”

Losses without donations are even bigger

For a more accurate measure of managerial competency at CR, you also need to consider what kinds of funds the organization includes when it reports operating income. In 2017, CR included $31.8 million in contributions (i.e. donations from individuals and foundations) in computing what it calls “Total revenue and support.” Don’t misunderstand: I’m not begrudging CR those donations. The organization deserves every cent of those for all the good work it does advocating on behalf of consumers.

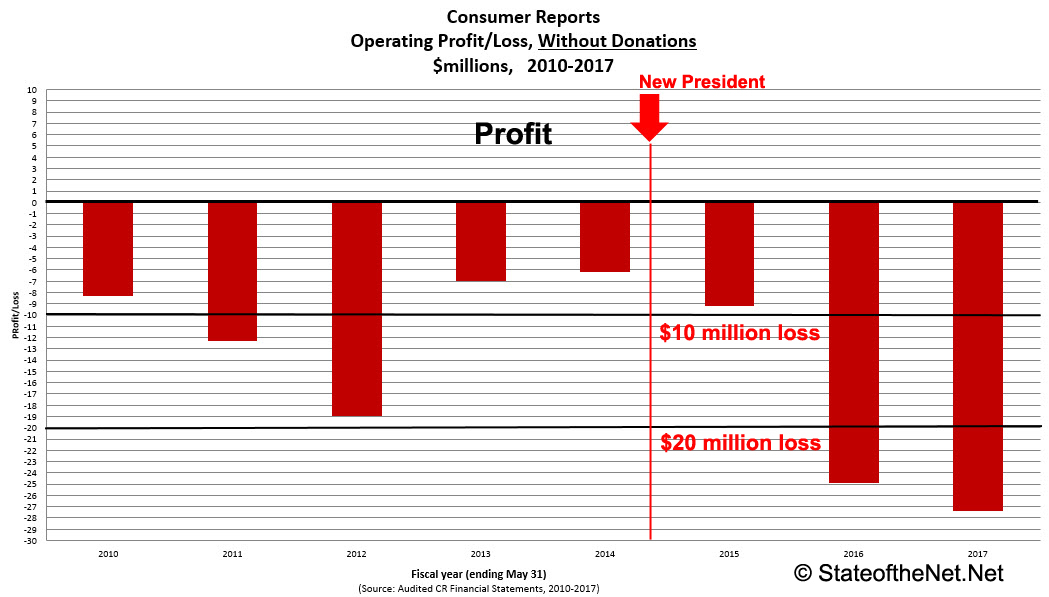

But donations are not a source of income from its core operation—sales of its flagship products—and do not measure how well the publishing operation itself is managed.

When you actually remove those donations (along with the fundraising expenses associated with them) from the operational bottom line, as I have done in this chart, you get a better picture of how the publishing operation itself is performing. As you can see, without donations CR has been recently running up losses as high as $20 million per year.

Just as alarming, over time, these donations have become a bigger and bigger part of CR’s operating revenue and support. Back in 2010, for example, contributions accounted for just 6.9 percent of CR’s operating revenue. In 2017, it accounted for 13.2 percent. More and more, then, CR is coming to rely on outside contributions (along with investment income) to keep afloat a publishing operation that is competing increasingly poorly in the marketplace.

Things might actually be worse

That’s not the whole story, either. The above data isn’t fully up-to-date, since it reflects only the available financial reports, which cover performance through May 2017. Statements for the fiscal year ending May 2018, which haven’t yet been released, might give a better indication of whether CR’s management halts the organization’s decline or merely continues its dysfunctional leadership.

About that dysfunctional leadership…

Since 2015, I’ve reported on how the group who took over Consumer Reports and disposed of most of its staff has tossed aside the organization’s ethics; driven out most of its best professionals, especially older ones; and ignored what one longtime CR subscriber told President Marta Tellado was a “gradual decline in quality of CR products.”

Based on some disgraceful behavior by CR’s leaders that just recently became public (more on that at a later time); the exodus of readers; and reports from staffers and ex-staffers; the leadership today appears to be just as, if not more, dysfunctional than it was when this crowd took over.

NOTE: Consumer Reports will have its annual public meeting on October 10, 2018, in New York City. To attend and express your views to CR’s leaders, apply by September 24. Details are here.

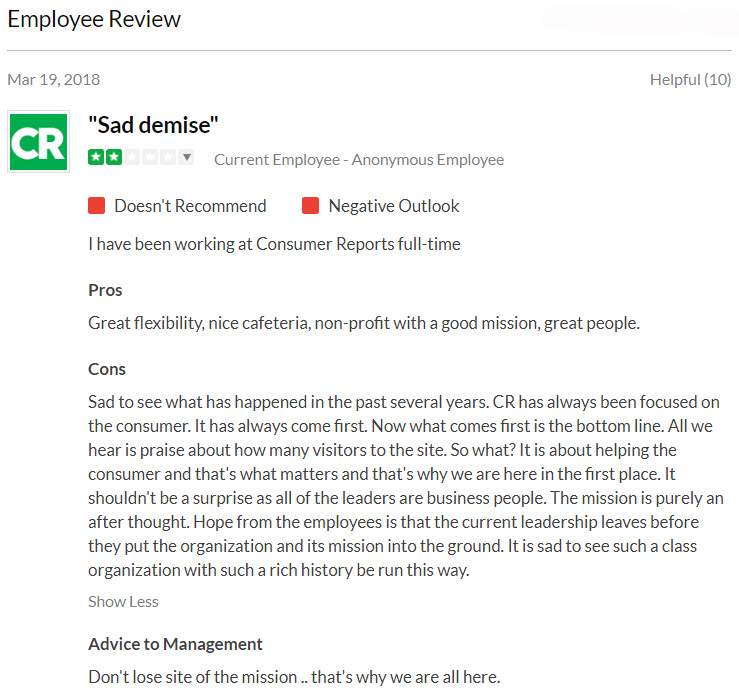

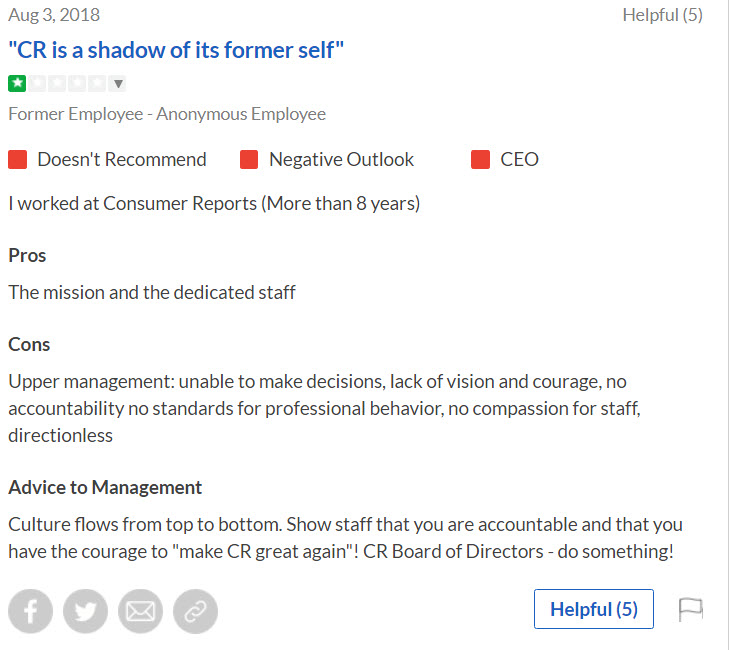

Here are three fairly recent reports by CR staff, as posted on Glassdoor

1. This staffer’s observation that, at CR, “the bottom line” takes priority over the consumer is telling, considering how poorly we see that CR leaders have managed their bottom line.

2. This former longtime staffer describes a “directionless” leadership that no organization should have to contend with.

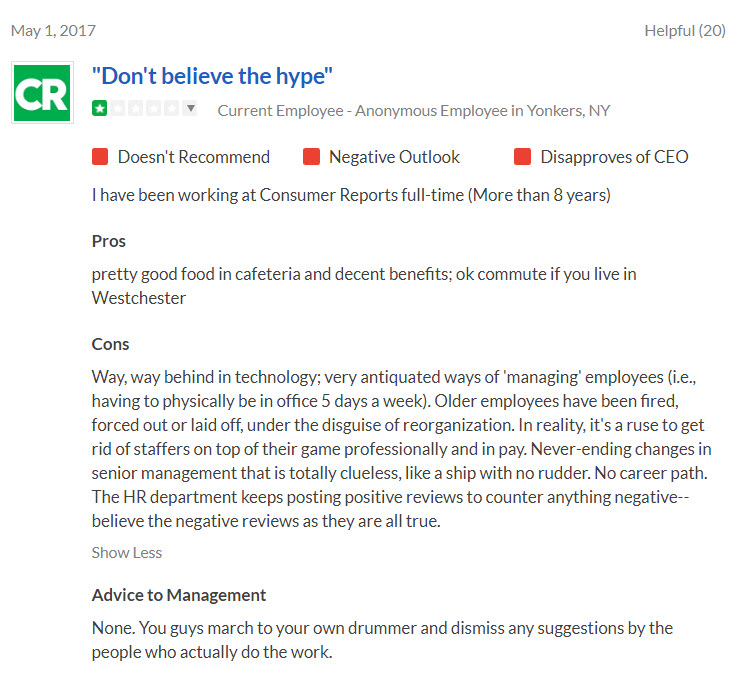

3. This longtime staffer captures the pathos of working for unscrupulous leaders who are beyond taking advice.

Dear President Marta Tellado,

An interview with you was just published in which you offer advice on how to “Successfully Manage A Team.” Your number one tip includes the following:

“Be genuine, transparent, honest, and accessible when you do. Don’t forget to set some ground rules for mutual respect so you can grow that trust throughout the organization.”

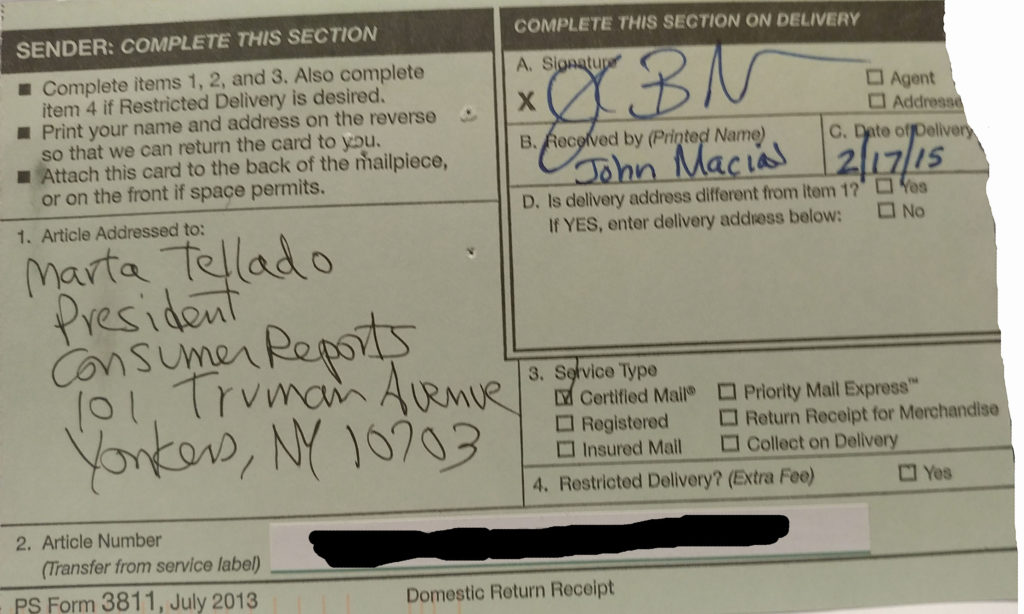

If you truly believe this, why have you tolerated liars, abusers, and sociopaths for years among your key executives? And why have you ignored for more than three years my certified letter to you, in which I reported “an executive who has used their position at CR to commit acts of gross dishonesty and unscrupulousness towards CR staffers.” This executive is still on your staff. To refresh your memory, here’s the signed return receipt I received from your office dated February 17, 2015.

–Jeff Fox